April 25, 2025

I’ll Leave The Political Commentary for Others

As I write this letter, I find myself questioning the developments unfolding at the White House. One day brings tariffs, the next brings reduced rates, followed by the removal of tariffs and then contradictory statements just hours later. This inconsistency fosters only confusion and uncertainty. Whether in investing, personal decision-making, or—most relevantly—government policy, an inability to maintain a consistent course inflicts more harm than good.

The true objective behind these policies remains unclear. Reshoring manufacturing jobs appears impractical. As many knowledgeable experts have pointed out, the time and cost required to relocate manufacturing facilities would likely be wasted, especially given the high probability of another policy reversal during such a transition.

Another unresolved issue is labor. With the labor market already near full employment, where would the workforce come from? If the plan relies on AI and automation to fill these roles, then aside from a short-term boost in construction activity, the long-term impact of reshoring may prove limited. One can only hope the administration has a well-considered strategy and avoids overplaying its hand.

Underwriting Downside Risk

During a volatile and broadly disappointing first quarter, equity price movements exceeded traditional downside underwriting assumptions. I’ve grown increasingly cautious about assessing downside risk, as stocks that report disappointing results often receive no immediate price support. The market now appears to view no valuation as too low when corporate earnings miss analysts’ expectations—regardless of whether the underlying issues are temporary or structural. This shift reflects a more punitive market posture: earnings misses are treated as permanent impairments, prompting indiscriminate selling. In such an environment, underwriting accurate risk-reward scenarios—both upside and downside—has become significantly more difficult.

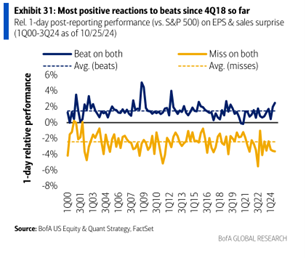

Data from Bank of America corroborates these observations. Exhibit 31 illustrates the average one-day relative performance of stocks following earnings announcements. Recent reactions have significantly exceeded historical norms: stocks beating expectations outperformed the S&P 500 by 248 basis points (bps) compared to a historical average of 148bps, while those missing expectations underperformed by 362bps, notably worse than the historical average of 245bps. Since Q2 2021, stocks missing both revenue and earnings estimates have persistently declined more than historical averages, resembling patterns observed during the Global Financial Crisis. I suspect the same conclusion will be drawn when this chart is updated again.

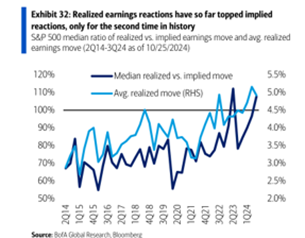

Additionally, the implied versus realized volatility relationship has notably reversed (Exhibit 32). Historically, implied volatility exceeded realized volatility consistently, with median realized moves typically between 60% and 80% of implied moves (2014-2021). Since Q1 2021, realized volatility has significantly risen, occasionally surpassing implied volatility, indicating that markets may now be underpricing risk. The tail risks implied by this scenario suggest potentially extreme stock moves, both positive and negative, far exceeding market expectations.

For investors and management teams, the current environment presents a series of distinct challenges. Long-term investors focused on compounding capital over extended periods must navigate heightened volatility. Companies will inevitably report both beats and misses across an investment horizon, making prudent position sizing essential. This helps ensure that single-stock drawdowns, particularly those triggered by earnings misses, do not disproportionately affect overall portfolio performance.

Flexible position sizing also creates opportunities. When temporary headwinds result in outsized price dislocations, investors can selectively add to positions. Given the market’s current indifference between temporary setbacks and permanent impairments, position sizing becomes even more critical.

In our portfolio, Donnelley Financial (DFIN) recently declined approximately 20% following disappointing Q4 results and soft guidance for Q1. The miss was driven primarily by a steeper-than-expected decline in their legacy paper and printing segment, as well as continued weakness in capital markets activity—particularly IPOs and M&A. However, our investment thesis centers on the company’s recurring software solutions segment, which grew organically by 11.6% in Q4. This growth signals underlying strength in the core business.

We believe the market has misread this temporary weakness as a permanent impairment, creating a compelling mispricing. 2025 forward estimates were revised down approximately 9%, and 2026 down 7%—the stock’s decline implies a permanent reduction of more than 10% in its terminal valuation multiple. This seems unjustifiably pessimistic. Should any stock, regardless of valuation, balance sheet quality, or industry context, be expected to decline 20%+ on a single earnings miss? The rise of multi-manager platforms engaging in event-driven, leveraged strategies may partially explain the growing severity of these reactions.

Management teams must also adapt to this landscape. Companies with strong balance sheets should capitalize on market overreactions by opportunistically repurchasing shares during temporary dislocations. Discipline and timing remain critical—many firms have exhausted capital on buybacks at peak valuations, only to lack flexibility when shares trade at far more attractive levels. Recent examples include Lucky Strike Entertainment and Dave & Buster’s.

In contrast, a company like Roku, which holds approximately $2 billion in net cash, generates positive free cash flow and has guided for near-term profitability, stands to benefit from buyback authorizations. These authorizations provide optionality, enabling timely and strategic repurchases during irrational selloffs, as was evident following Roku’s Q3 2024 results. We’ve continually messaged IR asking why they do not have one in place, to no avail.

While we avoid short-term, quarter-to-quarter trading, understanding the prevailing market psychology heading into earnings season has become increasingly important. Interestingly, the sharp negative reactions to earnings misses have not been mirrored by similarly strong positive responses to beats—an asymmetry that reinforces our view of opportunity.

Partnering with long-term-oriented, aligned management teams—those who remain unswayed by near-term stock price fluctuations—should continue to yield strong results over time. These indiscriminate sell-offs present attractive opportunities to increase exposure to high-conviction positions. Ideally, management teams are repurchasing shares alongside us.

No one ever said this would be easy.

Five Point Holdings Starts With a Bang

Our Q4 2023 letter stated that Five Point Holdings was a top pick for 2024. While it performed well, gaining 23% on the year, how a month makes such a difference. In January, Five Point reported robust Q4 results and guided 2025 to be equally as strong, guiding to $200m of Net Income, putting them in a net cash position. On this news, the stock rose 50% on the day following. Only a few years ago, we were increasingly worried about their upcoming debt maturity. Now, having the discussion 180 and moving to how they will deploy excess free cash flow in the coming years is a turnaround timeline we couldn’t have fathomed.

In Q4, we visited California to tour the properties and wrote up our reaction to Q1 results on our Substack. While the stock has pulled back during the recent market selloff, we continue to be bullish on the businesses future. San Francisco (Candlestick Park) should begin progressing towards the end of 2025/beginning of 2026, which is the next leg of the story. At just 0.5x our fair value estimate, the stock remains very compelling. A healthy balance sheet, an A+ management team, and strong demand for their properties equating to significant free cash flow should lead to strong stock performance in the future.

New Portfolio Positions

During the quarter, we initiated three new positions: BMW (Ticker: BMWKY), Mercedes-Benz (Ticker: MBGYY), and Compass Minerals (Ticker: CMP).

Our investment theses for BMW and Mercedes-Benz share many similarities. Both companies currently face headwinds from heightened competition, which has led to softer demand. However, they trade at highly attractive valuations and maintain low leverage—key attributes that position them well to navigate near-term challenges. Investors benefit from robust dividend yields, while ongoing share repurchase programs at discounted prices enhance long-term return potential.

Compass Minerals (Full report here) – High-quality assets trading at attractive prices stemming from recent management mistakes, removal from the S&P 600 index, and warmer winters resulted in this stock trading down to 6x our estimated normalized earnings. Salt road de-icing does not care whether the market is up or down, consumer preferences, or AI; salt must be bought if it snows. Compass is a high-quality business with a new management team and a back-to-basics agenda. Several side projects, including a fire retardant and a lithium extraction project, distracted their core salt and Sulfate of Potash (SOP) business. With these projects eliminated, combined with a typical winter, it will demonstrate the normalized earnings power of their business.

Portfolio Top 5 Holdings

At the end of Q1 25, our top 5 holdings represented ~34% of assets, with NVDA representing ~13% of the portfolio. The remaining four include cash (money market fund), QCOM, BKRIF, and BGC. We sold NVDA call options, which expire in June and are deep in the money. Once exercised, as opportunities arise, we will deploy cash generated from the covered calls over time.

I am attending the Berkshire Hathaway Annual Meeting in May. If you are interested in meeting, feel free to send an email or DM on X.

Regards,

Dominick D’Angelo, CFA Dominick@okeefestevens.com 585-497-9878

Disclaimer

This document is for informational purposes only. O’Keefe Stevens Advisory is not providing any investment recommendations with the publishing of this document, and no firm performance data is included in this document. Advisory services offered through O’Keefe Stevens Advisory, an investment adviser registered with the U.S. Securities & Exchange Commission.

No responses yet