July 19, 2024

Market Outlook

Continued hopes of near-term rate cuts drove a 3.9% gain in the S&P 500 in Q2, led by names you may have heard of – Nvidia, which was the largest company in the world for a brief second. Microsoft, Alphabet, Amazon, and Meta saw their stocks rise 10%+ in the first half. These five stocks accounted for ~63% of the S&P 500’s rally in the first half, led by Nvidia accounting for roughly half of the 63%. The S&P equal-weighted index again lagged its market cap-weighted counterpart, down ~2% in the quarter, displaying the concentrated and top-heavy nature of the rally.

During the quarter, the A.I. rally broadened beyond the obvious players of Nvidia, AMD, and hyperscalers. Qualcomm (QCOM), a long-standing investment, is gaining recognition for integrating artificial intelligence into mobile phones. Qualcomm’s A.I. on-device capabilities enable real-time language translation, improved voice recognition, and sophisticated imaging techniques as A.I. becomes more integral to mobile experiences. Qualcomm benefits by leading the market in providing robust, efficient, and versatile A.I. solutions. A.I. could be the first technology advancement in several years to accelerate the smartphone replacement cycle as users desire these advanced capabilities.

Corning(GLW), another long-time holding, announced Q2 results would come in better than anticipated due to outperformance in their optical connectivity products used for Generative AI. Corning has long been a disappointing investment; with leading-edge technology, it consistently underperforms expectations. Their “springboard” plan, which revolves around $3 billion of excess capacity, seems to be the first sign in a long time that they are ready for a surge in growth. Management has frequently discussed the potential for operating leverage in nearly every conference call, anticipating a return to normal business conditions. Margins should expand over the coming quarters, driving EPS growth. The $3B in incremental sales could be worth in excess of $900m in EBITDA.

While A.I. use cases appear endless, ROI on spending is far from known, blurring the visibility and duration of the ongoing Capex boon. Will spending hit an air pocket as hyper scalers and other players pull back to assess whether spending is an attractive ROI? Our recent quarterly call discusses portfolio holdings set to benefit from machine learning. We concluded that every business benefits from AI, but those not adopting the technology will fall behind. Employees need not be concerned about AI taking over their roles but how they can incorporate it into their jobs, making them more efficient. A personal anecdote is ChatGPT’s role in ramping up new ideas. The conversational nature and ability to distill complex topics into lamens terms is incredibly beneficial for those unfamiliar with industry terminology.

New Positions

We initiated two new positions during the quarter: Alibaba(BABA) and Perrigo (PRGO). Both have seen their stocks decline over 70%+ from their all-time highs.

Alibaba(BABA)

Alibaba is the largest e-commerce player in China, with 40% gross merchandise volume(GMV) market share through its Taobao and T-mall businesses. While the cloud computing business is relatively small, its 37% market share in China positions it well to capitalize on the increasing demand for AI-related products. In the most recent quarter, AI-related cloud revenue recorded triple-digit growth y/y, with the expectation that total cloud revenue will accelerate to double-digit growth in 2H 2025.

It’s rare to find a dominant market share business with significant tailwinds trading for ~10x adj. EPS. After accounting for their ~$60B net cash balance sheet, the stock is trading at 6-7x, which, we believe, is far too cheap. We understand this business would not trade at this price if it were a U.S. business. However, the valuation gap at a high single-digit P/E is pricing in a combination of the following risks – 1. China invading Taiwan. 2. Cash can never leave mainland China (disproven). 3. Increasing competition from Pinduoduo and Shien resulting in market share loss 4. China’s geopolitical tensions worsen. 5. Economic slowdown stemming from the recent housing market downturn. 6. VIE structure creates doubt over the actual ownership of the business. All risks have merit, with cash distribution restrictions at the lower end due to the recently announced dividend and special dividend. Cash returned to shareholders totaled $16.5B in FY24, up from $13.4B in FY23.

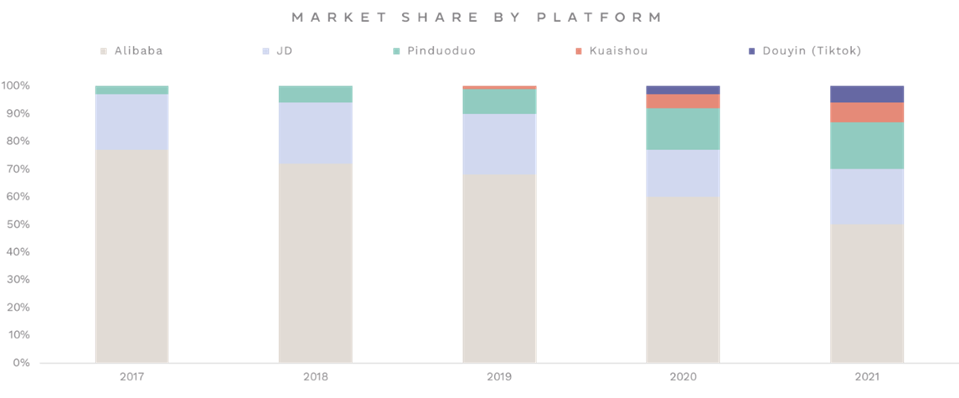

All investments carry risks; some can be diversified away, and others cannot. While incremental investments and spending will likely lead to margin compression, this is a necessary step to stabilize and potentially regain market share. The risk of continued market share loss from Pinduoduo (Temu), JD.com, Shein, and Douyin is shown below. Alibaba’s Chinese market share has declined from 78% in 2015 to 44% in 2022 and 40% in 2023. The under-reinvestment in the business opened the door for others to come in. Joe Tsai, Chairman, stated Alibaba had shot itself in the foot over the last decade, not prioritizing the end-user experience. Eddie Wu, who took over as CEO in late 2023, has prioritized improvements in the user interface. This reinvestment should help mitigate future market share losses. We expect capital returns through dividends and buybacks to continue for the foreseeable future. The business generates substantial free cash flow, cumulatively over the next 5-6 years, could total today’s enterprise value.

Perrigo (PRGO)

Perrigo offers over-the-counter (OTC) self-care and wellness solutions in the U.S. and internationally. In the U.S., the company primarily focuses on store brand products, whereas Perrigo markets its own brand internationally. The Consumer Self-Care Americas (U.S. business) represents ~2/3 of sales, with most revenue generated through store-branded products at retailers including Target, Walmart, and CVS. Products include pain relief, sleep aids, upper respiratory relief, and digestive health. Consumer Self-Care International (International business) represents ~1/3 of revenue concentrated in Europe. 90% of sales stem from Perrigo’s branded products, pain and sleep aid brands Solpadeine and Nytol, upper respiratory – Aflubin, and Physiomer.

Over the past several years, Perrigo experienced significant management missteps and regulatory changes. Investors have seen nothing but a downward trending business and stock price over the past nine years. Fatigue has set in. However, significant business developments, management changes, and new market opportunities, combined with an undemanding multiple and growth acceleration, have us encouraged that the future is unlike the recent past.

In August 2023, the FDA issued warning letters to Perrigo and two other infant formula manufacturers, ByHeart and Reckitt, for violations of the Federal Food, Drug, and Cosmetic Act and the FDA’s infant formula regulations. These letters are part of the FDA’s ongoing efforts to ensure the safety and quality of infant formula products and prevent contamination. As part of these efforts, the FDA updated its infant formula compliance program to enhance inspections, sampling, laboratory analysis, and compliance activities. This includes annual environmental sampling for Cronobacter and Salmonella. Perrigo, the only private-label infant formula manufacturer in the U.S., was required to shut down manufacturing facilities to modernize and update production lines to achieve compliance. The resulting downtime, along with several starts and stops, led to approximately $130 million in lost operating income. Guidance calls for infant formula stabilization in 2H 2024, with 2025 seeking to fully recover the lost $130m. We like this easy comparison and accelerating growth formula.

Management Change – Patrick Lockwood-Taylor joined Perrigo in June 2023. Before this, he held leadership roles, including President of Bayer’s North America Consumer Health Division. In the first quarter of 2024, he announced Project Energize, a three-year investment and efficiency program aiming to achieve $100 million to $110 million in pretax savings by 2026. Management has several ongoing initiatives, including SKU rationalization, an infant formula relaunch, the introduction of Opill (discussed below), and Project Energize. These efforts are designed to increase free cash flow generation, directed toward debt reduction. Currently, leverage stands above 4x, with expectations to reduce it to approximately 3x by the end of 2025. In a rising rate environment, it is unsurprising that the market is concerned about leverage levels. However, we anticipate these concerns will diminish as leverage decreases, leading to higher valuation multiples, lower interest costs, and incremental EPS growth.

Around 65% of women aged 15-49 use birth control, according to a survey conducted from 2017 to 2019 by the Centers for Disease Control and Prevention (CDC). In the first quarter of 2024, Perrigo introduced Opill, the first over-the-counter (OTC) birth control tablet. This total addressable market (TAM) is substantial, offering significant potential earnings if the launch succeeds.

Considering all current initiatives, we estimate that Perrigo (PRGO) can generate over $3.50 in EPS by 2025. A valuation of 14x earnings (a conservative estimate for a staples/healthcare business) translates to a $49 stock price. We anticipate mid-single-digit EPS growth beyond 2025, coupled with reduced leverage, which could result in a “Davis double play” of earnings growth plus multiple expansion.

Research Ideas

During the quarter, we launched a Substack, “The Lion’s Roar – Outside the Box Investments,” which can be found here. Most research reports will be posted here moving forward. Our first post was on Southwest Gas Holdings (SWX). We will post research reports, follow-up earnings notes, and management/industry conference notes. The move gives us increased freedom to post what we want in a manner consistent with our style. Ideas will consist mainly of long/short SMID cap US-listed securities. We aim to foster discussions, provide a source of idea generation, and grow our investing network.

Regards,

Dominick D’Angelo, CFA Dominick@okeefestevens.com 585-497-9878

Disclaimer

This document is for informational purposes only. O’Keefe Stevens Advisory is not providing any investment recommendations with the publishing of this document, and no firm performance data is included in this document.

No responses yet