October 14, 2024

Mistakes Happen – Time for An Honest Discussion

A name we’ve discussed on several occasions will no longer be, as we sold our stake in Graftech (Ticker – EAF) during the quarter. Long-term investment success is often shaped by a series of short-term events, most of which have been negative for this holding over the past three years. Purchases are underwritten based on a 3-5-year holding period, allowing for short-term headwinds to abate, market pessimism to subside, and long-term business results to dominate the discussion and stock price. We made our initial purchase at an unthinkable price of $12/share.

Initial thesis

- Graftech’s vertical integration with Seadrift and the production of Needle Coke provided a competitive advantage and lower operating costs.

- Reality – While still potentially the case, weak demand for electric vehicles has resulted in a healthy supply of needle coke. In a market where electrode demand is simultaneously weak, the added fixed cost of running Seadrift is a drag on profitability. In a supply-constrained market, Seadrift will undoubtedly be an advantage; however, today it is not.

- Pitch needle coke is not a viable substitute. Given that Graphite Electrodes comprise only 2-3% of steel production costs, customers are unlikely to risk switching to an inferior (pitch needle coke) product that could result in costly smelting disruptions should an electrode break.

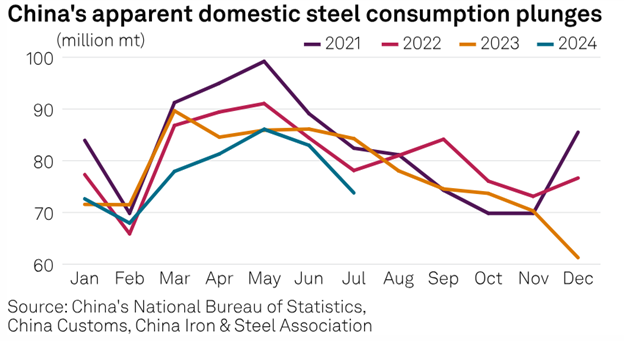

- Reality – In challenging markets, customers reduce costs wherever possible. China, often excluded from discussions due to economic opacity, remains a low-cost producer with significant export capacity. While Graftech’s product is likely of higher quality, steel producers opt for low-cost options to preserve margins and remain competitive in weaker pricing environments.

- Long-Term Contracts – Graftech’s long-term contracts (known as LTCs) entered into in 2018 provided revenue visibility for several years. Cash flows could be used for share buybacks and debt paydown.

- Reality – These contracts provided revenue visibility, and even though these contracts were higher (at times almost 2x spot prices), the cash flows generated went towards ill-timed buybacks and dividends. Given the cyclical and capital-intensive nature of Graftech’s business, debt reduction should have taken precedence over buybacks—a strategy misaligned with its high leverage (hindsight is 20/20). Additionally, the $0.40 dividend should have been deferred until leverage reached a more sustainable level. Brookfield Asset Management likely influenced the 2018 special dividend and subsequent quarterly dividends. While reducing leverage might have indirectly supported the stock price, dividends offered Brookfield a more immediate and direct return on their investment.

- We expected them to enter into new agreements when the long-term contracts ended. Customers were likely disinterested in entering new agreements after getting the short end of the stick the previous go-around. While customers benefited in 2018 from these contracts, from 2020-2023 when spot prices were well below contracted prices, a sour taste was left. Management discussed the negative impact of these contracts, resulting in lost customers.

Why sell now?

It’s become abundantly clear that our thesis was wrong, and the near-term viability of the business is in question.

In Q1 2024, Chinese electrode prices were $1,995/t. Even after tariffs and transportation costs, they remain cheaper than Graftech’s products. Furthermore, the legacy of those long-term contracts damaged customer relationships, contributing to ongoing business losses. In discussions with management, customers would not engage with them until Brookfield was entirely out of the picture. Relationships must be repaired and restarted; it is not easy.

In 2025, profitability will likely deteriorate as the remaining long-term contracts (contracted at ~$8,300 and ~14 tons) fall off. While 14 tons would be a minor issue when operating at higher capacity utilization, in 2024, sales volume will be ~100 tons. At approximately twice the current spot price, 14 tons represent about 22% of total revenue under these contracts. When these contracts are repriced to today’s rates, the $4,000/ton price decline flows directly through the P&L. Spot prices of $4,300, and management commentary suggesting pricing remained soft into Q3 were concerning. Graftech commences 2025 negotiations in October/November, typically representing 50%+ of annual sales volume. At $4,300/mt, Graftech is not profitable, even operating near 100% capacity utilization. Either forgo sales volume, operate at suboptimal capacity utilization, or lock in contracts at or near breakeven.

In July, S&P downgraded Graftech to CCC+, citing difficult market conditions and anticipating that the company will deplete most of its cash balance by mid-2025, after which it will need to rely on its revolver to meet liquidity needs. Graftech’s capital structure is unsustainable, given its elevated debt levels (maturity is not until 2028), depressed earnings, high interest expenses, and reliance on favorable market conditions to meet its financial obligations over the longer term.

A challenging and telegraphed Q2 prepared us to contemplate the next steps. We had a 1×1 scheduled with management in mid-August, which, depending on the discussion, would result in either buying more or selling. After the Q2 results, it became clear that management could say little to ensure the business would survive in its current form. In July, reports surfaced that Graftech contacted firms for a potential capital raise, an action that would permanently impair the investment. Although management reiterated that drawing on the revolver would be unnecessary in 2024, we anticipate it will become essential by June-July 2025 to cover their semi-annual interest payments. At quarter end, cash stood at $120m. We expect them to burn ~$50m in the 2H of the year, as rising production costs are offset by working capital release. With the unlikely probability of higher prices in 1H 25, volumes are the primary lever to drive improved profitability. A similar cash burn in the first half of 2025 will likely necessitate drawing on their revolver, further increasing fixed costs for a business that needs to preserve cash.

Rolling this scenario forward to 2H 25, should prices not recover to mid $5,000, Graftech could miss an interest payment. This investment has shifted from a bet on the transition to electric arc furnace technology to a call option dependent on a rebound in China’s property sector. This would be material thesis drift, which we are uncomfortable underwriting. The US government (most familiar to us) is unpredictable; underwriting China’s government intentions is several miles out of our circle of competence.

Put simply, in the current environment, China is everything. China’s property market, which accounts for over 25% of the country’s GDP, is facing significant issues (to put it mildly). Reduced regulations and lower rates hope to ease pain as property values declined 30% in some areas. Over the past decade, the property sector has been a significant growth driver. Steel demand is well below previous years, resulting in increased electrode exports. In the U.S., trade restrictions on Chinese imports range from 25% to 150%. In the EU, restrictions on Chinese and Indian electrodes range from 23% to 75% for Chinese products and 7% to 15% for Indian products, depending on size and grade. In today’s environment, these tariffs help, but they are not punitive enough to deter purchases from these countries.

Post-sale, China announced significant stimulus measures, resulting in Graftech’s stock appreciating considerably off the lows. Electrode production does not occur overnight, and sales are not negotiated in hours. An increase in electrode price and the rapid time frame needed to provide a lifeline seem unlikely. As a result, the probability of the call option paying off or not expiring worthless has improved.

A loss of this magnitude is challenging and provides lessons that we hope will allow us to avoid investments like this in the future.

Lessons

- Cyclical, capital-intensive, levered investments are challenging and require hard catalysts within a reasonable time frame.

- Private equity sell-downs often trump fundamentals in the near term. Waiting for the seller to exit the position allows for a better entry point and removes excess selling pressure. Understand the motivation of management and related parties.

- Determine who the marginal price setter is. While every electrode participant excluded China, the bet ultimately lived/died in China. Due to the opacity of the Chinese market, determining supply and demand dynamics has been nearly impossible to calculate.

- Cheap on a replacement value is irrelevant for a cash-burning business.

- Expect the Unexpected—Our thesis did not fully account for unthinkable events, from a Mexican plant shutdown to geopolitical tensions and China’s property market collapse. Extreme events must always be considered.

Highlighting successes and failures is part of the investing game. We aim to learn and improve our process to reduce the probability of a mistake of this magnitude repeating. Our approach remains rooted in diligence, critical analysis, and transparency. We continue refining our investment process, informed by our successes and failures.

Portfolio Position Update

Five Point Holdings (FPH) – To end the quarter, we received positive news regarding one of the last overhangs plaguing Five Point. Luxor Capital, which owns approximately 10 million shares, has consistently sold its position. Recently, Luxor filed a Form 4 indicating that they sold nearly 90% of their remaining position, with well-regarded value investor Robert Robotti acquiring 6.7 million shares. Five Point continues to perform incredibly well, with a significant overhang behind us, we are incredibly excited for the weighing machine of the market to value the stock appropriately.

BGC Group (BGC) – After a long-awaited arrival, the FMX Futures Exchange launched on September 24th. Years of expenses flowing through BGC’s financials without offsetting revenue are reversing. While we are keenly aware of the ramp-up period from 0 volume to market share gains provided by the CME, FMX’s compelling offerings are anticipated to gain market share slowly. In addition, per BGC’s standard practice, announced revenue and pre-tax income will come in at the high end of management’s guidance.

Uncertainty is BGC’s best friend. Entering 2024, rate cut expectations of 150bps reflected optimism around the aggressive and dramatic decline of rates. In September, a 50bps cut marked the first rate cut since 2020 and the reversal after 2.5 years of interest rate hikes. Officials target a range of 4.25-4.50% by the end of this year, which signals two quarter-point rate cuts or one half-point cut. For 2025, they expect to cut four more times, bringing their Fed Funds rate to 3.25-3.5%. We are unconvinced the higher inflation experienced in recent years is over, putting these rate-cut expectations at risk. For BGC, whether we experience 50 bps cuts or 150 bps, conflicting economic data points will continue driving record volumes. With one sell-side analyst covering the name, this stock continues to trade under the radar and remains a core holding.

Research Ideas

Southwest Gas Corporation (SWX) – In our income portfolio, we initiated a position in Southwest Gas Corporation, a utility provider in Nevada, Arizona, California, and Utah. Florida has become less affordable due to higher insurance costs (in parts, unable to get) and rising HOA fees. And as desirability declines resulting from increasing natural disasters. The likelihood of future retirees opting for locations where they do not have to worry about their house getting destroyed or moving into a residential complex that could become unaffordable on a fixed income will result in a generation no longer retiring in the southeast—instead, the West. Population growth will drive incremental power demand in Southwest’s regions.

Anecdotal conversations with friends cited the inability to close on a home in Florida as they could either not find insurance or the quote made the home unaffordable. While Florida has a beneficial tax code, making it cheaper on the surface to live relative to Arizona and Nevada, the cost of living differential is slowly eroding these benefits, which is unlikely to reverse.

Southwest submitted rate case filings to each respective state in the near term, proposing significant rate base increases that would drive near-term EPS growth.

Thesis

- Increasing population in Nevada and Arizona will drive incremental capex and rate base growth.

- Sell down of CTRI stock paves a path toward share buybacks and debt reduction.

- Near-term rate base increases drive EPS growth ahead of expectations.

Seaport Entertainment Group (SEG) – Another Nevada (partially) play we wrote about is Seaport Entertainment Group (SEG). A recent spinoff from Howard Hughes (HHH). We were, and continue to be, intrigued by the idea, as a $5B company spinning off a $300m hodgepodge of assets can create interesting trading dynamics. We visited the Tin Building in New York’s Seaport District in June. To say the building was stunning would be an understatement (then again, with a $200m remodel, it ought to be). Discussions with managers and servers provided interesting insights, detailed in our Substack post “Seaport Thoughts and Waffling.” We passed on the idea, though we have a diligence trip to investigate the properties further in November. On the surface, the assets are highly likely to be worth more than the current market value. However, the Tin Building is incinerating cash and other near-term office vacancy headwinds, which have us worried this is cheap on an asset value and expensive on an NPV. A lesson we’ve learned from Five Point Holdings.

Regards,

Dominick D’Angelo, CFA Dominick@okeefestevens.com 585-497-9878

Disclaimer

This document is for informational purposes only. O’Keefe Stevens Advisory is not providing any investment recommendations with the publishing of this document, and no firm performance data is included in this document. Advisory services offered through O’Keefe Stevens Advisory, an investment adviser registered with the U.S. Securities & Exchange Commission.

No responses yet