January 27, 2025

2024 was an eventful year, with our largest position, Nvidia (NVDA), appreciating over 170% as business remained robust, to say the least. Nvidia continues to face a good problem: product demand significantly outpaces supply. Their competitive advantage keeps widening as they announce and launch advanced GPUs and data center infrastructure. In March 2024, Nvidia revealed the Blackwell GPU architecture, introducing the B100 and B200 data center accelerators. These GPUs achieved substantial performance gains for AI workloads, surpassing the prior Hopper-based H100 GPUs. The B100 featured enhanced tensor cores and memory bandwidth, enabling faster AI model training and inference. You’ll notice how similar paragraph 1 sounds in our Q4 2023 and Q4 2024 letters.

In our Q4 2023 report, I made three predictions: Top picks for the year – Five Point Holdings (FPH) and AerCap (AER); a top 25 position is acquired; and the top-performing index for 2024 – Russell 2000.

Results

Five Point Holdings & AerCap Grade: A-

In our previous letter, we mentioned Luxor’s exit from Five Point Holdings, as Robert Robotti acquired a substantial portion of their stake, reducing selling pressure. From September 23rd to October 3rd, Five Points stock price increased ~31%. Several days later, longtime shareholder Castlelake announced the sale of their stake to the Glick Family Office, led by CIO Sam Levinson, who was added to the board and has a background in real estate. The stock subsequently retreated, finishing the year up 23%, outperforming the Russell 2000 and on par with the performance of the S&P 500. It was a volatile end to the year amid a relatively stable asset. Business performance was strong throughout the first three quarters, as land sales and land prices continued to trend positively. In Q2 2024, Five Point sold 12 acres of Great Park land for an average price of $7.8m/acre, up from $4.3m in the same period the previous year. Management further stated that land prices have moved higher, with prices per acre in the $9m range. We believe the stock remains attractive and expect 2025 to be another good year.

AerCap performed well in 2024 due to a robust secondary market for used aircraft stemming from supply shortages. Throughout 2024, the stock rose steadily, finishing the year up 29.8%, while initiating its first dividend in May. Our thesis remains unchanged as secondary transactions occur at significant premiums to carrying values. We are most excited that lease renewals signed in 2023-2024 will finally impact results, improving profitability. We expect AerCap to compound book value in the mid-teens over the next several years. We expect another year of above-average returns as the stock trades at tangible book value, 7.5 times our 2025 EPS estimate, and optionality related to Russian insurance claims.

Top 25 positions acquired in 2024 Grade: F (This is either an A or F – pass/fail)

While we hold positions in several markets ripe for consolidation, Lina Khan and the FTC sued to block seemingly any and every acquisition, deterring companies from pursuing M&A. Costly legal battles and increased odds of a deal falling through made the deal math increasingly complex. Entering 2025, with a new, more business-friendly, and likely less restrictive administration, we expect M&A activity to improve.

Top performing index – Russell 2000 Grade: D

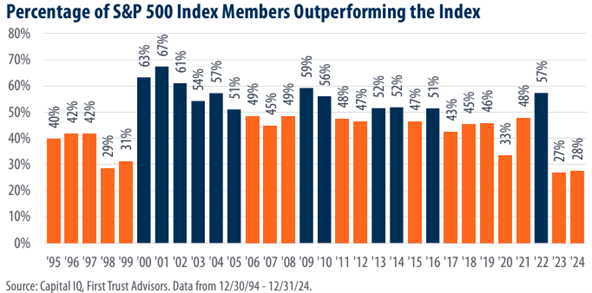

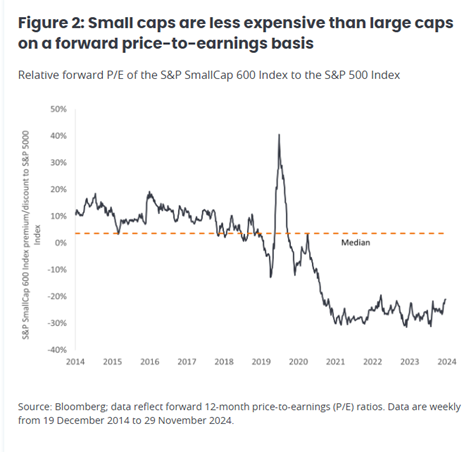

Small caps continue to lag substantially behind large caps. Companies driving large-cap (S&P 500) performance are the all-too-familiar names (Magnificent 7). Business results at these companies continue to defy the law of large numbers, consistently outperforming what appear to be elevated expectations. That said, it was a tale of two halves from July 10th through the end of 2024, as the S&P SmallCap 600 index delivered a total return of 9.6% compared to the S&P 500’s 5.1% return. Small caps are our favorite hunting ground, as they are underfollowed and cheap, creating a promising setup.

2025 Predictions

- Top picks for 2025 – Beyond Inc (BYON) and Donnelley Financial (DFIN). We posted our updated Beyond write-up to SumZero on 12/19 as part of their 2025 top stock picks contest (we placed 3rd in the micro/small cap division; please email if interested in the full write-up, or it can be found here).

- Another wave of Canadian lumber mills curtail production due to the 30% duty rate set to be implemented in August 2025.

Beyond Inc (BYON)

Beyond operates as an asset-light e-commerce company, owning and managing a portfolio of retail brands such as Overstock, Bed Bath & Beyond, Baby & Beyond, and Zulily. With a high EBITDA-to-free-cash-flow (FCF) conversion and low capital requirements, it is positioned to scale efficiently. Recent acquisitions, including Bed Bath & Beyond (2023) and Zulily (2024), have expanded their reach while revealing management missteps and growing pains related to brand integration and operational execution.

Thesis

1. Leadership and Vision – Chairman Marcus Lemonis employs a hands-on, performance-driven leadership style. His compensation is equity-based, with options linked to significant stock price appreciation ($45, $50, and $60 strike prices).

2. Asset-Light Model – Beyond’s capital-light approach minimizes fixed costs and facilitates high FCF conversion, with incremental return on invested capital (ROIC) near 100%. This positions the business for profitable growth as revenue scales.

3. Valuation Opportunity – Beyond trades at distressed levels, with a market cap of $234m and a price-to-sales ratio significantly below peers. Analyst FY25 revenue estimates of $1.49B are overly pessimistic and extrapolate recent trends, which are likely to reverse. Market share gains and a stabilizing furniture market should drive revenue above estimates, bolstered by improving customer acquisition metrics and app usage trends.

4. Strategic Partnerships – A recent $25m investment in Kirkland’s offers multiple synergies:

A brick-and-mortar presence for Bed Bath & Beyond through “shop-in-shops” and standalone stores (both operated by Kirkland’s, as Beyond will maintain an asset-light model with no retail footprint or inventory ownership). Reduced e-commerce return costs by utilizing Kirkland’s locations. Enhanced brand visibility to address consumer misconceptions regarding Bed Bath & Beyond’s bankruptcy.

5. Optionality in Private Equity Investments – Beyond’s investments in Tzero (blockchain-enabled securities trading) and GrainChain (digital agriculture solutions) provide mispriced optionality. Both assets are valued conservatively on the balance sheet despite positive developments such as Tzero’s regulatory approvals and GrainChain’s growing traction in the industry.

Catalysts

- The sale of headquarters to Salt Lake City leaves the company debt-free.

- Continued stabilization in the furniture market alongside improved market share metrics.

Why the Opportunity Exists

1. Execution Missteps – Previous leadership committed a critical error in shutting down the Overstock brand. Current leadership set overly ambitious revenue growth forecasts, reducing credibility. These issues have negatively affected investor sentiment.

2. Cash Burn Concerns – High marketing expenses and the relaunch of acquired brands have temporarily strained cash flow, raising fears of insolvency.

3. Tax Loss Selling – Beyond’s stock declined ~82% in 2024 and 21.5% in December alone. Tax-loss harvesting likely resulted in excessive selling pressure as the year closed.

Risks

1. Cash Burn and Profitability – The business remains unprofitable, and prolonged cash burn may force Beyond to monetize its private equity investments at less favorable valuations. Failure to achieve cost discipline or revenue growth could worsen these concerns.

2. Execution Risks – Management has a history of missteps, including poorly timed website launches and nearly investing in distressed companies like The Container Store. Ineffective marketing spending could impede customer acquisition and retention efforts.

3. Industry Dynamics – A reversal in the recent stabilization of furniture sales could adversely affect revenue growth. Competitors like Wayfair maintain a substantial lead in market share (~9%) compared to Beyond (~1%).

4. Index Removal Risk – Falling below the market cap threshold for the Russell 2000 index could heighten selling pressure, further depressing the stock price.

Donnelley Financial Solutions (DFIN)

Donnelley Financial Solutions (DFIN) is a market leader providing compliance, regulatory, and transaction-related solutions to corporations and investment companies. It operates two main segments:

Capital Markets (68% of TTM revenue) – Services include IPO filings, M&A support, and ongoing compliance solutions.

Investment Companies (32% of TTM revenue) – Aids investment management firms (mutual funds, ETFs, and alternative investments) with ongoing regulatory filing requirements.

Unlike competitors offering only partial services, DFIN stands out as an end-to-end provider with solutions encompassing a business’s lifecycle.

Thesis

1. Recurring Revenue Growth – Software solutions account for $322m in TTM revenue and are experiencing rapid growth with high incremental margins. Management projects mid-teens growth for this segment, supported by improvements in retention (Gross Retention Rate increased from 89% in Q1 2024 to 93% in Q3 2024).

2. Event-Driven Business Recovery – Transactional revenue tied to M&A and IPOs (~25% of TTM revenue) will benefit from improving activity levels.

3. First-Mover Advantage in Regulatory Solutions – DFIN’s Tailored Shareholder Reports (TSR) platform is expected to generate $11m-$12m in annual recurring revenue, capitalizing on new SEC mandates.

4. Strong Competitive Position – Leading SEC filing agent for funds and corporations. Despite industry headwinds, growing market share in the Virtual Data Room (Venue) segment.

5. Management Alignment – Executive incentives are tied to software sales growth and EBITDA margins, aligning with shareholder interests.

Why the Opportunity Exists

1. Stock Overhang – Director Jeffrey Jacobowitz, previously a 7.7% shareholder, has significantly reduced his stake, creating near-term selling pressure and suppressing the stock price.

2. Transition Challenges – The shift from transactional to subscription models has temporarily increased churn and subdued growth metrics.

3. Market Skepticism – Weak IPO and M&A activity has overshadowed the company’s transition to higher-margin recurring revenue streams.

Valuation

The current valuation reflects skepticism about DFIN’s ability to achieve software growth targets. The stock is undervalued as margins expand and revenue growth accelerates. A successful strategy execution could result in $7+ EPS by 2027, supporting a $140+ stock price at a 20x multiple.

Catalysts

- Completion of the share overhang from Jacobowitz’s sell-down.

- Recovery in M&A and IPO activity.

- Continued improvement in key metrics such as ARR and retention rates.

- Enhanced investor confidence through earnings outperformance.

Risks

1. Execution Risk—Failure to achieve software sales growth. The new administration’s reduced regulatory burden could result in less filing activity.

2. Market Dependency – Prolonged weakness in IPO and M&A volumes could delay transactional revenue recovery.

3. Insider Selling – Jacobowitz’s continued sell-down may suggest internal concerns or limit near-term stock appreciation.

The complete write-up is available on our Substack (The Lion’s Roar)

Reflecting on 2024 – How Our Process Evolved

Results in 2024 were satisfactory, with Nvidia and Fannie Mae (FNMA & FNMAS) showing positive performance, while Warner Brothers Discovery (WBD), Graftech (EAF), and GreenFirst Forest Products (ICLTF) significantly underperformed. In Andrew Walker’s Yet Another Value Podcast, he frequently asks guests, “The market is a competitive place; why do you think this opportunity exists?” I find myself asking this question more often. Although we consider ourselves highly analytical and thoughtful investors, the market is fiercely competitive and continues to grow. We compete with firms with unlimited resources, access to alternative information, and management teams on speed dial. We don’t have to engage in the same game as everyone else. Patience is key. The long-term approach is becoming less competitive as more people enter the quarterly earnings games. (no quantitative data to support this) Volatility on earnings day seems to be amplified as traders position themselves based on their thesis for how the quarter and guide will play out. Covering, post results. We never position portfolios based on what we think will occur in the next quarter or two; instead, what is the business’s long-term outlook, holding through the short-term noise or headwinds.

Understanding who is selling and why has become a priority in our research, and therefore, understanding who are shareholders and their thesis. We aim to identify situations where buyers and sellers are indifferent to the prices they transact. In the write-ups for Beyond and Donnelley Financial mentioned above, it should have been clear why we believed these two opportunities existed. Both stocks faced excessive selling pressure due to factors unrelated to their fundamentals. Specifically, regarding Beyond, we identified when the selling pressure would ease—year-end. As for Donnelley, although the timeline remains uncertain (Jacobowitz stepped down from the board in November and no longer needs to file Form 4s), we can reasonably estimate the duration for him to exit his position fully. Additionally, the shares are held through Simcoe Capital, enabling us to monitor 13F filings to gain insights into the remaining shares to be sold (if the plan is for a complete exit).

Understanding this dynamic is increasingly relevant as private equity becomes a major factor in the public space. Many securities we analyze have substantial private equity shareholders who will likely exit at some point. When a stock faces selling pressure, business results may be strong, yet the stock might not move — the classic voting versus weighing machine. Knowing who is voting helps us identify better entry points. This is where patience becomes essential. Recognizing that upside is limited during the private equity sell-down (or larger shareholders), we can wait patiently until the end is near. Markets are becoming more rule-based—index inclusion/removal, factor-based rules, and the shift to passive investments drive daily stock price fluctuations. We continue to seek ideas that may eventually benefit from these rules (BGC – index inclusion, LAZ – C-Corp conversion). Finding ideas where market participants need to buy the stock regardless of price are ones we are actively trying to find.

Research Reports During the Quarter

During the quarter, we did not initiate any new positions. However, we updated our previous research reports on Donnelley Financial and Beyond Inc., the summaries of which are posted above. You can read the Donnelley report here and the Beyond report here. If you are interested in discussing these positions, please reach out! These companies have almost no coverage and are ones where we feel like we have an edge.

Portfolio Top 5 Holdings

At the end of the quarter, our top 5 positions were NVDA, QCOM, BGC, GLW, and BKRIF.

Regards,

Dominick D’Angelo, CFA Dominick@okeefestevens.com 585-497-9878

Disclaimer

This document is for informational purposes only. O’Keefe Stevens Advisory is not providing any investment recommendations with the publishing of this document, and no firm performance data is included in this document. Advisory services offered through O’Keefe Stevens Advisory, an investment adviser registered with the U.S. Securities & Exchange Commission.

No responses yet