Please click the button below to download a PDF of the most recent newsletter.

Mid-Year Update

We started 2023 in what seemed to be a no-win economic quagmire. Inflation had reached record levels at the end of 2022. The Federal Reserve had its back against the wall. Either tighten the grip on the economy by raising rates or risk runaway inflation. This, of course, would push our economy (and the global economy) into a recession. Either option offered a bleak outlook for the stock market.

I’m delighted to report that neither a recession nor rampant inflation has been the outcome thus far. And, as I’m sure you’ve noticed, the stock market has performed well year-to-date.

Sentiment has not been the only hurdle for investors in 2023. Add to this, a long list of problems we’ve managed to navigate as a nation. Bank failures, rising tension in China, a war in Ukraine, and the US debt ceiling crisis. 2023 has been an endurance event, and we’re only halfway through the year! Give yourself a pat on the back, it’s been a rough ride, yet you’ve endured.

This year provides a lesson on exactly what it takes to be successful investors. Despite the uncertainty, we must maintain our conviction in this approach. We are patient, disciplined, plan-focused, long-term, investors. And, in today’s investing world, we are the exception.

The World is Short-Term Focused

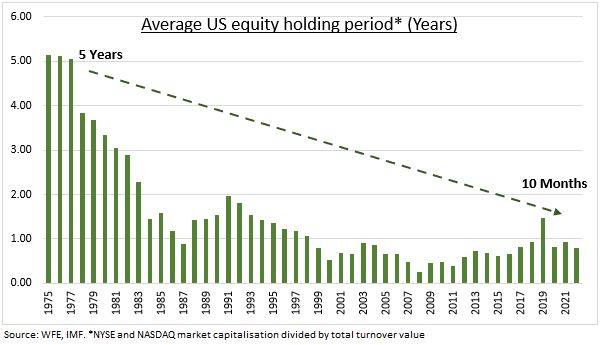

The average holding period for an individual stock in the U.S. is now only 10 months, down from 5 years back in the 1970s.

There are a host of reasons for the increased frequency of trades. Trading costs have decreased, technological innovations have increased, and more people invest today. Furthermore, the amount of information available to investors has never been greater. We perceive it’s the constant stream of information that contributes the most to trading.

Yet, more trading doesn’t equal better results. We know most investors perform worse than market averages over the long term. In fact, there’s a company called DALBAR, Inc. that does a study every year about this subject. They find that the average holding time of a mutual fund is only 2.5 years. And, the average investor in mutual funds has worse performance than the funds he owns!

Why? Because timing the market doesn’t work.

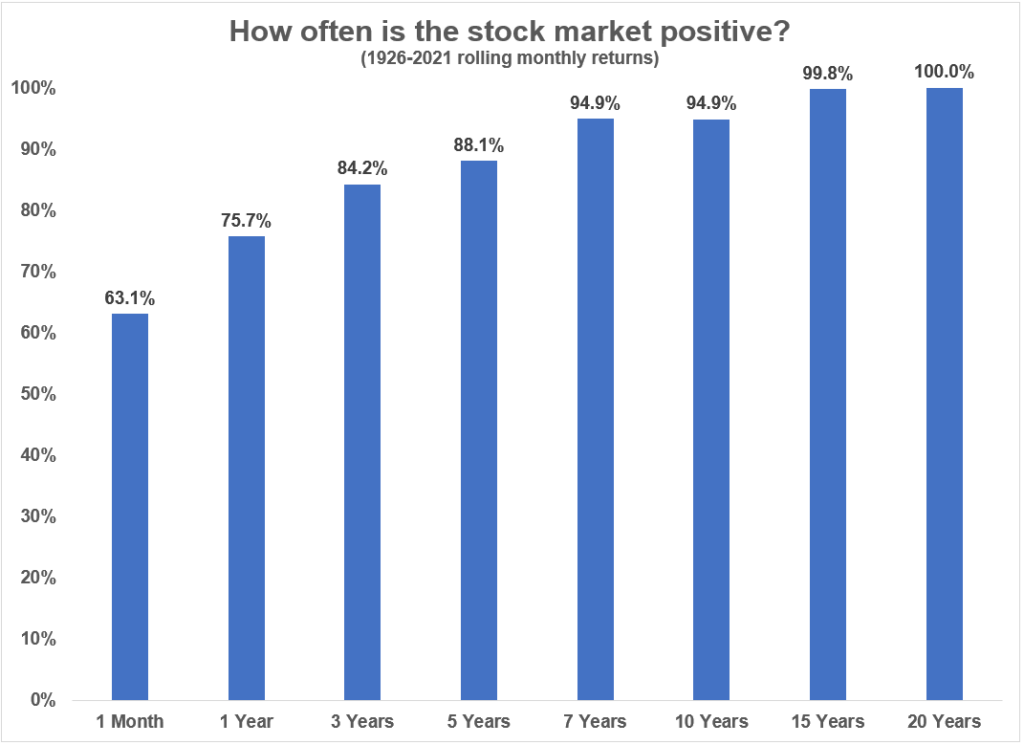

Consider the information in the chart above. Historically, the longer your time horizon in the stock market, the higher your probability of a positive outcome.

For many investors today, even one month is a long-time to own a stock. Most companies report their earnings quarterly. The questions we hear on these calls from institutional analysts are often laughable. And, unfortunately, it puts pressure on management teams to meet these short-term objectives. The shift in focus to short-term results is happening in every corner of our industry

But, this is not to say that all investors or all company managers have conceded to short-termism. In fact, we look for company managers who align their incentives to match our long-term focus. And, these are often some of the best-managed businesses in the world.

You do not need to be ultra-sophisticated to succeed as an investor. It’s more important to get the big things right and to recognize time as your ally. Simple things like good savings habits, patience, and a long-time horizon work. One of our core tenets as your advisors is to maintain this long-term focus.

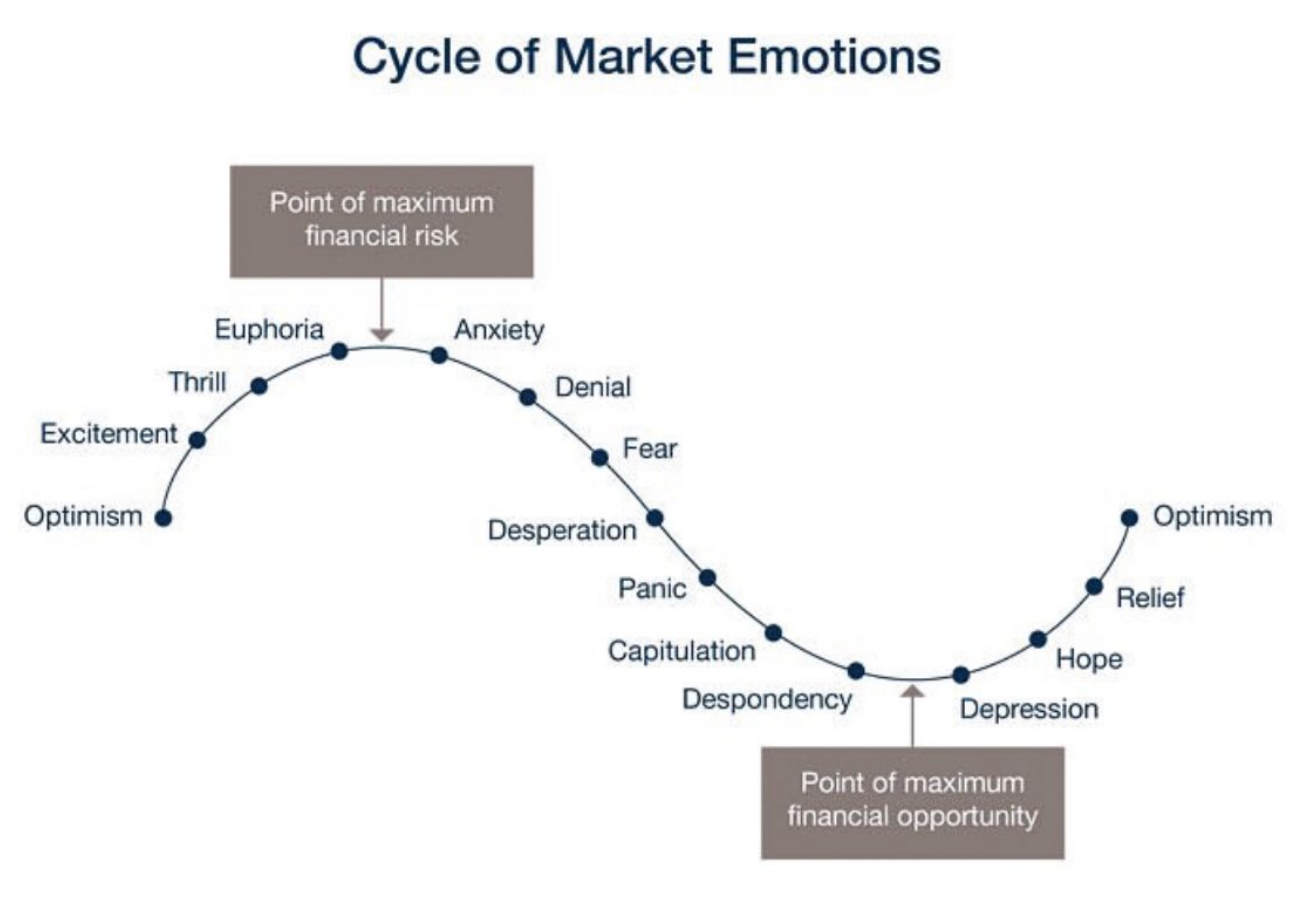

The Market Has an Emotional Cycle

The emotional cycle of the market is always going to be the background noise. The antidote to it is our long-term, goal-focused, plan-driven investment process. Most of the time, we need to treat the noise as exactly what it is: just noise. At extremes, we need to use it to our advantage. As Howard Marks calls it, “taking the temperature of the market.”

There will be times when it becomes obvious that investors are too emotional. It could be across the entire market. Or it could be within specific sectors or even specific stocks. We look (and wait patiently) for the extremely obvious instances of emotional disconnect. The times when optimism or pessimism has overtaken rational decision-making. At these points of extreme, our job becomes simple, but not easy!

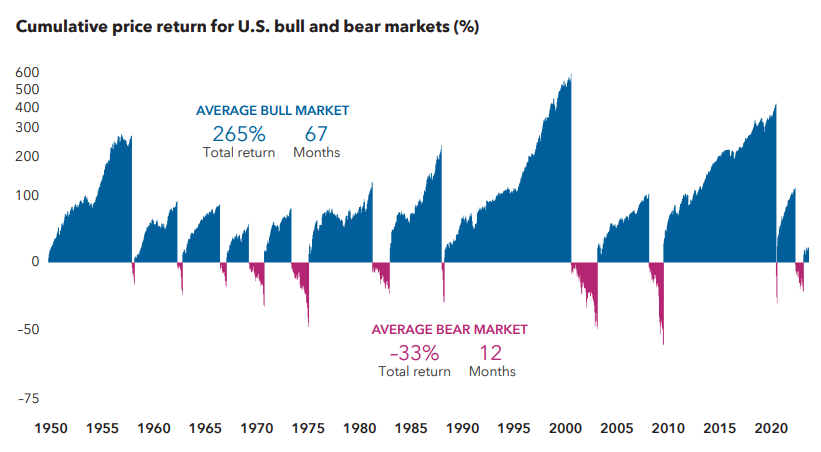

Bulls Outlast Bears

Looking back through history, it’s plain to see that Bull Markets last much longer than Bear Markets. Going back to the 1950s, Bear Markets averaged 12 months and reduced the value of stocks by a third on average. Compare that to the market advances, which last over 5 times as long and produce an average return of 265%. This is proof of the investment adage: “Time in the market is more important than timing the market.”

A recent behavioral survey of investors shows people prefer to outperform in market declines. Meaning, they would much rather lose less than everyone else than gain more in upward markets. Go back to the Bull Market, Bear Market Chart. Since 1950, Bull Markets las over 5x the duration of Bear Markets. Clearly, the better time to be outperforming is during the Bull Market!

Throughout history the market has prevailed, even though there are reset periods. While unpleasant, it is these periods of uncertainty that prove to be outstanding buying opportunities. Our only task is to recognize them for what they are when they arrive.

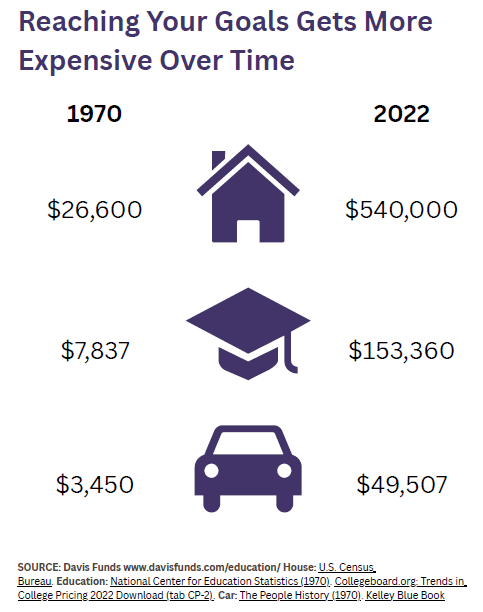

Reaching Your Goals Gets More Expensive Over Time

Getting the big things right is one of the key lessons in investing. Our entire life experience has been one of rising costs. And, if we’ve lived longer than two decades, we’ve experienced premium equity returns.

Understand these two simple, yet powerful ideas, and you have 90% of the problem solved. Yet, it appears to us that many investors miss the forest for the trees when planning their futures.

The chart above provides a clear example of the declining buying power of the U.S. Dollar. The utility value of these common large purchases hardly changes. But the cost in dollars of these items has ballooned over the past 50 years. This is the essential problem that needs a solution when planning a multi-decade financial goal.

Understanding the problem provides us with a direct question to seek our solution. “What provides us with the best protection in a multi-decade, rising-cost environment?”

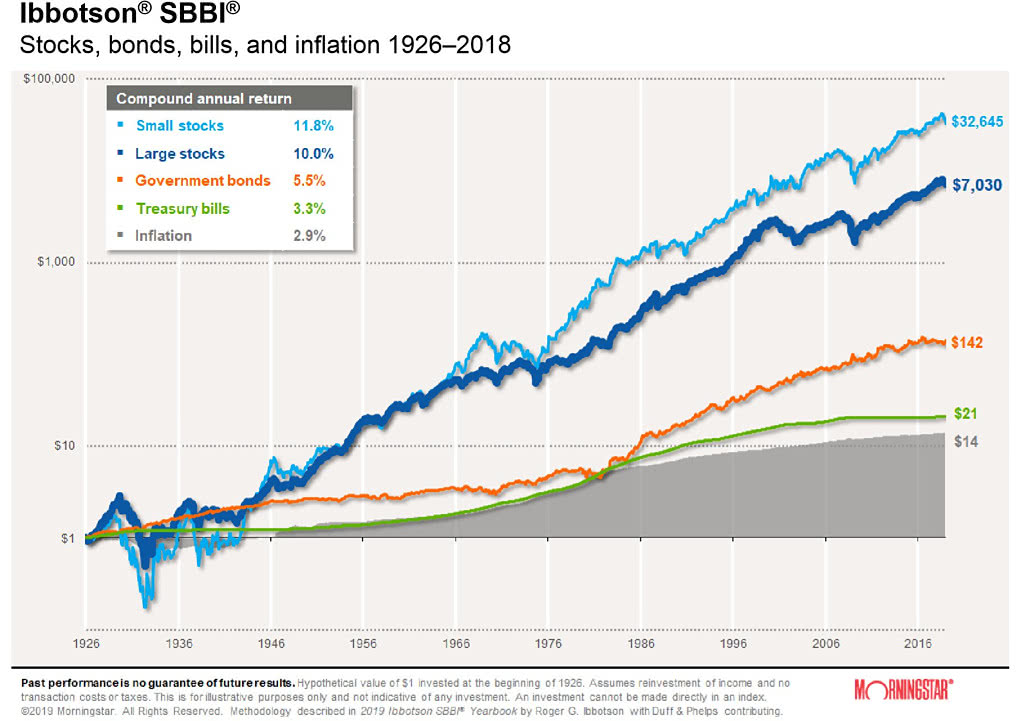

The chart above beautifully illustrates our answer. The equity markets have provided the best possible hedge against inflation. Whether it be small companies, large companies, private companies, or real estate, it doesn’t matter. Ownership assets are the key to success if you are looking to maintain purchasing power.

There are plenty of nuances to consider in financial planning. But, the dominant consideration (i.e. greater than the sum of all other parts combined), is how you defend against inflation.

NVIDIA Letter to Clients

Click here to read Peter’s Nvidia Letter to Clients

Peter spent the month of July putting together his thoughts on our largest portfolio holding Nvidia. As an owner of this business, it would be well worth the time to read this document to better understand our position and our team’s thinking about how to proceed.

Team Updates

Baby girl, Courtland Mae Flanigan, was born at 11:50 PM on July 16, 2023, weighing in at 5 lb 12 oz and 19.5 inches long. a die-hard Bills already, it was her prerogative to make her exit before the stroke of midnight so she could have a 716 birth date! (For our out-of-state clients, 716 is the Buffalo, NY area code).

Carly Mike and Courtland are doing well. Congratulations!

Save The Date

O’Keefe Stevens Advisory, Inc. Investor Forum

Thursday, October 12, 2023 – 5 PM to 8 PM

The Buffalo History Museum

1 Museum Ct., Buffalo, NY 14216

What We Read This Quarter

The One Thing

Gary Keller’s book The One Thing is a guide for achieving success by focusing on what matters most. Keller is the co-founder of the national real estate brokerage business, Keller Williams. His story of personal success is an interesting one. Keller experienced a significant plateau at the midpoint of his career. Instead of choosing a comfortable life, he chose the path less traveled.

The book is a consolidation of Keller’s life lessons and is an easy and informative read. It emphasizes the importance of identifying and prioritizing your one most significant goal. By mastering time management, eliminating distractions, and honing discipline, Keller explains how to pursue your chosen goal relentlessly.

The book encourages adopting a mindset of purposeful simplicity. Keller provides a toolkit for concentrating on the essential tasks that align with your vision. This was one of the most impactful personal development books I have read recently. If you are looking for actionable advice for a personal or professional goal, this is a fantastic place to start.

Golf Is Not A Game of Perfect

Bob Rotella’s Golf Is Not A Game of Perfect is a book I revisit each summer when my golf game plateaus (i.e. declines). A must-read for our golf clients, but an interesting read for non-golfers or fans of the game.

Rotella’s insights transcend the sport, offering valuable life lessons. He delves into the mental aspect of the game, teaching readers how to master their minds and improve performance. This is more of a guide on motivation and self-improvement. It offers wisdom that can be applied both on and off the course.

10 Things Everyone Should Know About American History

This pamphlet is available for free online, here. We are entering another political season. I offer a pause from mainstream media. This short read offers a reflective return to our roots as a nation.

Allen Guelzo reminds us of the vital importance of understanding our nation’s history. This is one of the responsibilities of being a knowledgeable voter. It’s important we don’t forget the lessons learned from our past struggles and triumphs. This book serves as a beacon, guiding us toward a more informed and thoughtful approach to our civic duties.

My hope is that reading it inspires a more intentional approach to understanding the issues we face as a country. And, hopefully, a more balanced approach to the variety of viewpoints in our world today.

Disclaimer: Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of O’Keefe Stevens Advisory and may change without notice. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security.

Investment advisory services are offered through O’Keefe Stevens Advisory, Inc., an SEC Registered Investment Advisor.

© 2023 O’Keefe Stevens Advisory, Inc. All rights reserved. This content cannot be copied without the express written consent of O’Keefe Stevens Advisory, Inc.

No responses yet