Celebrating Independence and Financial Freedom

As you gather with family and friends to celebrate the Fourth of July and commemorate American independence, we ask you to reflect on the principles of freedom and prosperity that define our nation. There is no historical equivalent to the conception or execution of the Great American Capitalist Democracy each of us enjoy today. Two and a half centuries ago, our founding fathers gathered to create a system whereby individual initiative, hard work and thrift were given totally free rein as a fundamental human right. We call this liberty, and it is the unique right that defines our nation and allows each of us equality of opportunity.

It is in this spirit that we share this quarter’s thoughts and announcements with you. We wish you all a wonderful Independence Day and thank you for your continued trust in our team.

The Declaration of Independence: A Transcription, archives.gov

Introducing Grace Stolberg, Financial Advisor

If I haven’t already had the privilege of meeting you in one of your meetings with Justin, or at one of our recent client events, hi, I’m Grace!

I joined the fabulous team of people here at O’Keefe Stevens in September 2023 as an intern. I had just finished another summer internship with a local wealth management firm, when I received a message from Justin on LinkedIn, congratulating me on my current internship and asking if I’d want to come to the office to learn more about his firm, as well as a new internship position he and the team were considering at the time. I had met Justin before, as he was invited to speak in my classes at Nazareth University by several of my professors, so I gladly welcomed the invitation. Apparently, I did something right, as I’m sitting here today as a full-time financial advisor with the OSA team. I worked with Justin throughout my senior year as an intern for about seven months, sitting in meetings, taking a lot of notes, asking even more questions, and learning the OSA way. After getting licensed as an investment advisor in February, I fully joined the team as an advisor on April 1st (luckily for me, not an April Fools’ joke).

Since my first day as an intern at O’Keefe Stevens, I realized I was in a place that will allow and encourage me to become not just the best advisor I can possibly be, but the best person and teammate. This team is truly an exceptional group of people- but I’m sure you’re already quite aware of that fact. I’ve thoroughly enjoyed the wisdom, stories and life lessons (Peter), kindness, and support that has been shared with me by all six of my team members.

I knew I wanted to be a financial advisor, and I dove headfirst into the start of my career while I was in college. What I did not know, though, was just how much more passionate I would become about my career choice. At this point, I’ve sat with Justin in hundreds of client meetings, worked with him on countless financial reviews, and am now starting to lead my own meetings. What a great feeling it is to wake up each morning, knowing I’m going to have great conversations with hardworking and bright people, and then put my knowledge to use to help them build a plan to achieve their desires. I love my job.

I cannot wait to meet more of the awesome clients of O’Keefe Stevens as I continue to sit in Justin’s meetings, as well as begin leading my own. Although, I may be a face you only see on Zoom, as I recently moved to the Sunshine State after graduating in May. I currently reside in New Smyrna Beach, so if you’re ever in Florida, give me a ring! I always welcome the opportunity to meet a new face and have a good conversation.

Sincerely,

Grace Stolberg

Follow the Money: The Journey of Liquidity in the U.S. Since the Global Financial Crisis

Since the Global Financial Crisis in 2007-2008, the United States has experienced an unprecedented injection of liquidity into its economy. Our Federal Reserve’s aggressive monetary policies, intended to stabilize the financial system, have led to a significant increase in the money supply, and consequently the U.S. debt-load. I thought it would be helpful to explore how this influx of liquidity has permeated American households and businesses, boosted investment portfolios, home equity prices, and contributed to the current inflationary environment. I’ll also discuss how this record level of net worth and liquidity level of U.S. households would suggest inflation (across all categories, including the markets) will persist in the coming years.

Let’s start by going back to the collapse of Lehman Brothers which kicked off the most severe worldwide economic crisis since the Great Depression. Loose-money lending policies to low-income homebuyers led to an excessive buildup of toxic “subprime mortgage” assets in banks across the nation. It eventually became clear to investors that these assets (once considered a stable, fixed income product) were a faltering house of cards, propping up a bubble in U.S. housing which could never be sustained. This in turn resulted in a mass exodus to cash assets occurring both in the equity and fixed income markets.

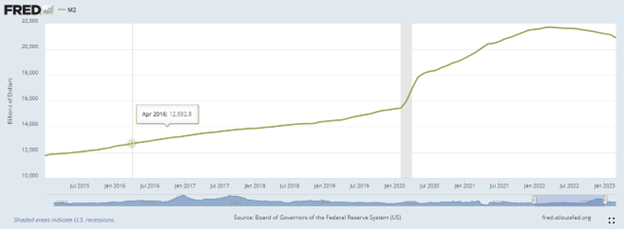

In response, the Federal Reserve implemented a series of unconventional monetary policies, including quantitative easing and lowering interest rates to near-zero levels. These measures were designed to stimulate economic activity by making borrowing cheaper and increasing the M2 money supply (M2 money supply includes cash, checking deposits, and easily convertible near-term assets). And it worked. The markets eventually stabilized and financial institutions returned to performing their regular functions once again.

However, the story continues. The Federal Reserve had put its hand in the cookie jar, and now had an insatiable taste for even more M2 money supply. From approximately $8 trillion in 2008, the M2 money supply grew to over $15 trillion by 2019. This immense injection of liquidity was well-intended to revive economic growth, encourage lending, and support financial markets. All good things.

But is too much of a good thing, really a good thing?

The injections of newly minted cash quickly found their way into financial markets, driving up asset prices. As interest rates remained low, investors sought higher returns in equities, leading to the prolonged bull market we have all enjoyed. Consider that the S&P 500, for example, has surged from around 750 points in early 2009 to over 5,500 as of the writing of this newsletter. More than a 630% increase in value! This dramatic rise in stock prices significantly boosted the net worth of American households and businesses with investment portfolios.

The real estate market also benefited from the flood of liquidity. Low mortgage rates spurred demand for housing, leading to rising home prices. Between 2010 and 2024, the median home price in the U.S. increased by 88%, enhancing household wealth through increased home equity. Homeowners saw their net worth rise as property values appreciated, creating a wealth effect that further stimulated consumer spending and investment.

Then came the Covid-19 pandemic in 2020. By this time, politicians and the Fed had developed a full-blown addiction to printing money. Faced with a crisis of plummeting economic activity and sky-rocketing unemployment, they went back to their most reliable medicine for curing symptoms: M2 money supply. From February 2020 to its peak in March 2022, M2 money supply grew from 15.4 trillion to just shy of 22 trillion dollars.

Source: St. Louis Fed M2 Money Supply Monthly, in Billions

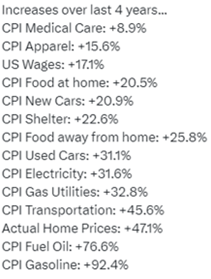

The surge in liquidity and resultant wealth effects led to increased consumer spending at levels we’ve never seen before. Compounded by supply chain disruptions, labor shortages, and other pandemic-related challenges, the U.S. economy entered a classic demand-pull inflation scenario. Prices for goods and services rose as demand outpaced supply, pushing prices to levels not seen in decades.

Consumer Price Increases in the U.S. 2020-2024

Source: Charlie Bilello, “This Week in Charts,” June 14, 2024

As it stands today, inflation has become a significant concern for American households. The largest cohorts impacted by inflation are the elderly (living on fixed income) and young households (with lower incomes and more mouths to feed). The Consumer Price Index (CPI) shows year-over-year increase of over 5%, but this hardly captures the full story, which is better told by the chart above.

What the Federal Reserve decides to do next is the question of the day. Clearly the monetary policies of our recent past are unsustainable and would create an enduring consequence of even more inflation. The Federal Reserve is now faced with the challenge of balancing economic growth with the need to contain rampant inflationary pressures.

But it’s not all doom and gloom.

Today, U.S. households have seen their net worth reach record levels. As of June 7th, 2024, U.S. household net worth ended the first quarter of this year at a record sum of $160 trillion. This is a leap of 37% from the $117 trillion at which it ended 2019 – just prior to the economic crisis set off by the global pandemic. For scale, consider that U.S. GDP (total economic output of our country) is currently about $29 trillion, and the total value of the S&P 500 is around $50 trillion). This is a staggering statistic. This surge in wealth has provided a cushion for consumers, enabling continued spending even in the face of rising prices.

In addition to high net worth, U.S. households hold unprecedented levels of cash. Checking account balances ($4 trillion), money market funds ($6 trillion), and CDs ($3 trillion) have swelled as consumers are saving more to weather economic uncertainties and maintain spending levels.

From our perspective, these high levels of liquidity and net worth suggest that households have the capacity to sustain spending, potentially fueling further inflation. As the economy continues to recover, pent-up demand could keep upward pressure on prices. And the stock market may continue to benefit as well. With interest rate levels projected to decrease and company earnings continuing to march upward, we could see significant cash reserves looking for investment opportunities. The combination of strong corporate earnings and abundance of liquidity bodes well for future market gains.

It won’t be all gain and no pain though.

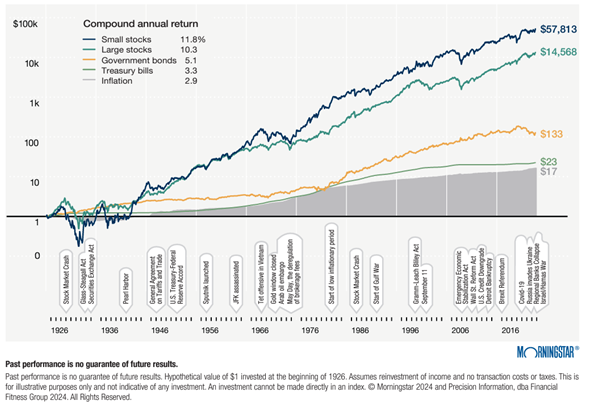

The path forward will never be easy. This year we’re faced with uncertainty in a U.S. election, global tensions, and the possibility of unforeseen crisis. However, we hold confidence in the enduring power of human ingenuity and the ability of financial markets to adapt and grow despite these ever-present headwinds. History has shown that resilience and innovation will prevail, paving the way for a brighter economic future. I’ll leave you with the most compelling chart I know of to illustrate this evidence.

Stocks, Bonds, Bills and Inflation 1926-2023

Source: Morningstar © 2024

New Technologies at O’Keefe Stevens: Holistiplan and Pontera

We’re continually striving to integrate new technologies that enhance our services and benefit our clients. This quarter, we began using Holistiplan and Pontera to make further steps forward to providing your with comprehensive and effective financial planning.

Holistiplan, a powerful tax planning software, offers detailed tax analysis and the ability to model Roth conversion strategies with precise tax detail. This technology allows us to deliver tax planning by uploading and analyzing your tax returns and identifying opportunities for tax savings and other advanced tax planning strategies like Roth conversions and Donor Advised Fund contributions. With Holistiplan, we can provide exact tax planning advice ensuring you retain more of your hard-earned money. This proactive approach not only simplifies tax planning but also helps with getting organized during tax season.

Pontera, a sophisticated tool for Employer Sponsored Retirement Plan management, further enhances our service offering. Pontera enables us to serve as your investment advisor on your current and former 401k, 403b, TSP, and 457 plan accounts. Studies show that utilizing an advisor to manage your retirement plan can add up to 3% in net returns annually (according to Vanguard Group’s Advisor Alpha study). Pontera’s capabilities in fund selection, portfolio rebalancing, and personalized invest advice ensure that our client’s retirement accounts are optimized for growth and aligned with their other investment accounts and retirement objectives.

By integrating Holistiplan and Pontera, we are better equipped to provide holistic financial planning to address all aspects of your financial lives. These technologies will take our planning and investment guidance to yet a higher level, ensuring you receive our highest level of service and the best possible outcomes for your financial future. We look forward to discussing them with you in our future conversations.

Disclaimer: Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of O’Keefe Stevens Advisory and may change without notice. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security.

Investment advisory services are offered through O’Keefe Stevens Advisory, Inc., an SEC Registered Investment Advisor.

© 2024 O’Keefe Stevens Advisory, Inc. All rights reserved. This content cannot be copied without the express written consent of O’Keefe Stevens Advisory, Inc.

No responses yet